Can businesses charge a credit card processing fee on refunds? Let’s discuss the legal aspects, industry practices, and how to handle refund processing fees. So, you can maintain customer satisfaction and compliance.

Refund practices represent a frequent business need since many industries encounter regular customer returns and cancellation events. Businesses encounter difficulties regarding the processing costs for refund transactions. The substantial charges for credit card processing have caused business owners to ask whether they can add processing fees when returning customers’ funds.

This article examines all legal aspects together with ethical and financial implications linked to refund processing fees. This article explains merchant agreements along with the regulatory requirements and optimal procedures for refund processes which support strong client relationships.

Understanding Credit Card Processing Fees

The expenses referred to as credit card processing fees develop whenever customers utilize their cards for payments.

The merchant has to pay a processing fee to their bank whenever customers use credit cards for payments. Processors charge merchants 1.5 to 3.5 percent for each transaction based on Visa, Mastercard, American Express, or Discover networks and their established agreements with companies.

Multiple payment expenses are settled through these fees which include different costs.

- The card-issuing banks receive interchange fees to process payments through these fees.

- The card network receives Assessment Fees as part of the credit card processing system.

- Payment service providers charge Payment Processor Fees to their clients.

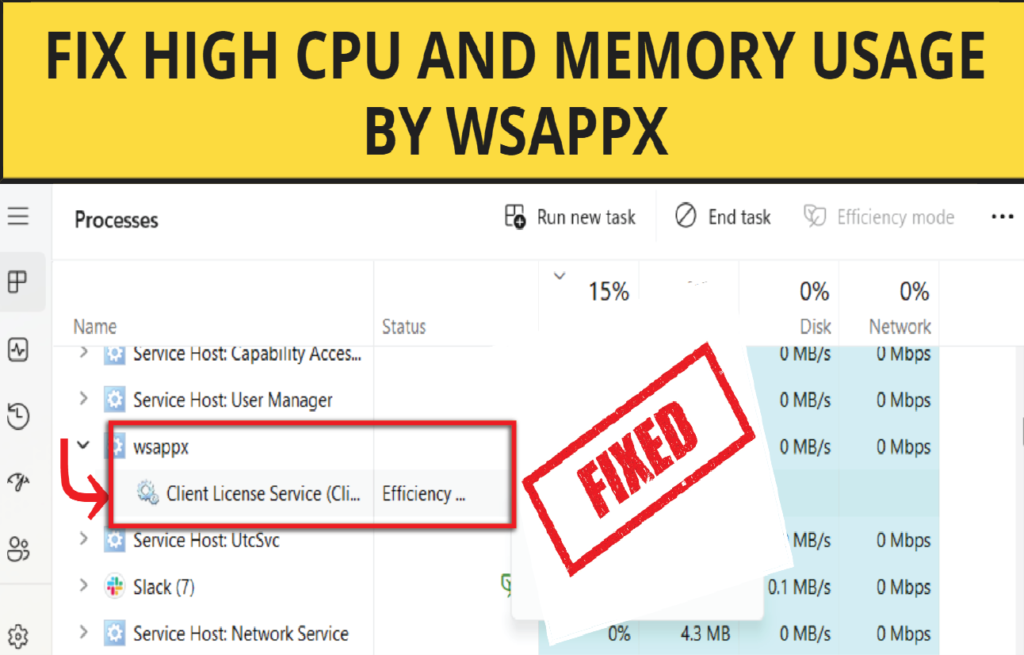

How do Credit Card Processing Fees Affect Refunds?

Refund procedures experience impacts from the costs merchants pay their processors to handle credit card transactions

The business transaction gets reversed during merchant refunds in the payment system. The business usually does not receive reimbursements for credit card processing fees associated with the original sale. The merchant gives up the purchase along with processing fees in these circumstances.

Many businesses now seek answers regarding their right to subtract fees when conducting refunds because of lost revenues.

Explain – Can You Charge a Credit Card Processing Fee on Refunds?

The decision depends on both merchant agreements and existing laws. This piece examines the main elements that influence whether businesses can impose processing fees during refund transactions.

1. Credit Card Network Rules

Credit card networks have specific policies regarding refund transactions. Here’s how major card networks handle processing fees on refunds:

- Visa & Mastercard: Do not refund processing fees to merchants when a refund is issued. However, they also prohibit businesses from deducting these fees from the refund amount unless clearly stated in the refund policy.

- American Express: Similar to Visa and Mastercard, processing fees are non-refundable, but merchants must disclose any refund deductions in advance.

- Discover: Generally follows the same guidelines as other networks, requiring transparent policies if fees are deducted from refunds.

2. Merchant Agreement with Payment Processors

Payment processors like Stripe and Square along with PayPal establish distinct rules about consumer refunds by their terms.

- Stripe has maintained its standard position regarding refund processing fees since 2023 by not returning any costs to merchants. The company must pay the fees unless they specifically announce different terms through their refund policy.

- Square applies fees from its processing service directly towards its refunded transactions. The payment regulations forbid merchants from imposing extra fees to customers when they request a refund.

- PayPal does not issue processing fee refunds unless the customers are explicitly informed about the terms.

3. State and Federal Laws

Consumer protection rules throughout various jurisdictions prohibit businesses from applying unannounced fees to refunds except when businesses explicitly recognize them in pre-transaction statements. Some key legal considerations include:

- Under U.S. Federal Trade Commission (FTC) Regulations businesses must deliver what they promise regarding refunds by avoiding any unnoticed charges.

- California along with other states has established strict consumer protection legislation that bars businesses from conducting fee deductions when returning money to consumers unless customers provide explicit consent beforehand.

- Countries in Canada along with Australia implement consumer protection regulations that enforce open disclosure about refund procedures to consumers.

4. Contractual and Ethical Considerations

Even if legally permissible, charging customers a fee for refunds may lead to:

- Customer Dissatisfaction: Many customers expect full refunds and may leave negative reviews or dispute the charge.

- Chargebacks: If customers dispute the refund deduction, the business may face costly chargeback fees.

- Reputation Risks: Poor refund policies can damage a business’s reputation and reduce customer loyalty.

How to Handle Credit Card Processing Fees on Refunds

If you’re concerned about losing money on processing fees, here are some best practices for handling refunds efficiently:

1. Implement a Clear Refund Policy

To avoid disputes, ensure your refund policy:

- Clearly states whether processing fees are non-refundable.

- It is displayed prominently on your website and receipts.

- Is acknowledged by customers before purchasing.

2. Offer Store Credit Instead of Refunds

Instead of issuing refunds, consider offering store credit or exchanges. This retains revenue while providing customers with a resolution.

3. Use a Partial Refund Policy

Refund processing fees become a business deduction only after advertising their presence transparently to customers. For example:

The fee for processing refunds stands at 3% because credit card businesses cannot recover their charges. Before purchases businesses should ensure the policy follows local laws while providing clear communication about its contents. Ensure this policy complies with local laws before purchases.

4. Work with Your Payment Processor

Some payment processors offer discounted refund fees or alternative processing structures to reduce losses. Contact your provider to explore options.

5. Prevent Refunds Through Better Sales Practices

Minimize refund requests by:

- Offering detailed product descriptions and accurate photos.

- Providing excellent customer service to resolve issues before refunds are requested.

- Implementing a quality control process to reduce defective products.

Conclusion – Can You Charge a Credit Card Processing Fee on Refunds?

So, can you charge a credit card processing fee for refunds? In most cases, only if your refund policy explicitly states it and complies with credit card network rules and local laws. While businesses often absorb processing fees on refunds, implementing a transparent refund policy and exploring alternative solutions can help reduce financial losses.

If you’re considering charging fees on refunds, always ensure legal compliance and prioritize customer satisfaction to maintain trust and long-term business success.

FAQs – Can You Charge a Credit Card Processing Fee on Refunds?

Q1. Can I legally charge a credit card processing fee on refunds?

It depends on your jurisdiction, credit card network policies, and whether your refund policy discloses this practice before the transaction.

Q2. Do all credit card processors keep the processing fee on refunds?

Most payment processors, including Visa, Mastercard, Stripe, Square, and PayPal, do not return processing fees when a refund is issued.

Q3. How can I avoid losing money on credit card processing fees for refunds?

Consider offering store credit instead of refunds, implementing a partial refund policy, or negotiating lower refund fees with your payment processor.

Q4. What happens if I deduct processing fees without disclosing it to the customer?

If your refund policy does not state that processing fees will be deducted, the customer may dispute the charge, leading to chargebacks or legal issues.

Q5. Can I pass credit card fees to customers instead of absorbing them?

Many businesses add a credit card surcharge at checkout to cover processing fees, but this must be disclosed upfront and comply with local regulations.