Let’s discuss the Best Countries to Invest In 2025. Here is a complete guide to eleven different countires and their opportunities.

Making great investments is a matter of time, place, and plan. Although most investors focus on industries and assets, it may be equally important to select a country in which to invest. Whether you are business-friendly or you are in an emerging economy with high returns, this guide will tell you how to choose the best country to invest in right now.

If you are an experienced investor or a first-time investor looking to invest internationally, diversifying your portfolio abroad is an effective step towards financial opportunity.

Reasons Why International Investment Makes Sense

Global investing can help you diversify investment risk, tap into global markets with tremendous growth potential, and explore innovative ventures that may not be available in your local market. Investors prefer certain countries due to their good political stability, tax breaks, and the country’s ability to diversify its economy.

Gauging the parameters of ease of doing business, legislative provisions, economic development, and industry performance, among others, we have been able to come up with the best destinations as far as international investment is concerned.

1. Singapore- The Financial Powerhouse of Southeast Asia

Singapore provides a perfect combination of economic stature, tax benefits, and global access. It is a major entry point to business in Asia, and the legal structure is sound, and the business environment is one of the most business-friendly in the world.

Strong sectors:

- FinSci and banking

- Biotech and healthcare

- Trade and transportation

Why invest:

- Transparent regulations

- Low company taxes

- High-quality infrastructure

Singapore- The Financial Powerhouse of Southeast Asia

2. United Arab Emirates (UAE): The Tax-Free Investment Haven

Theseare fast developing into an international investment destination. It has 0% income tax policy and pro-business reform, which presents immense opportunities to entrepreneurs and real estate investors.

Investment highlights:

- Luxury and commercial real estate

- Smart tech startups and AI

- Green energy projects

Why invest:

- Free trade areas

- Modern infrastructure

- Stocks issued with high demand by the investors

|

3. India – an emerging consumer society

It is a rapidly growing consumer society nowadays. India has one of the largest young populations with a digital transformation, and this has made India one of the most promising markets in the world. It is a long-term investors’ hotspot with the emerging internet penetration and start-up innovation.

Top industries:

- E-commerce and online finance

- Construction and structures

- Health and education technology

Why invest:

- Good GDP growth

- Government incentives

- The roaring middle class

India – an emerging consumer society

4. Germany- Europe’s Economic Anchor

The combination of industrial and economic strength enables Germany to be one of the outstanding investments in terms of long-term value. It suits the investors who want to invest in developed and technology-focused industries in an over-controlled market.

Leading sectors:

- Automobile & Transport

- Green technology and solar energy

- Medicines and health

Why invest:

- Market access in the EU

- Superior labor force

- Export-focused economy

5. Vietnam – Manufacturing the Rising Star

Vietnam is among the prolific economies in the Asian continent. It has established itself as one of the best sites for low-cost production, technology outsourcing, and export-oriented firms.

Key areas:

- Textiles and electronics

- Agri-and aquaculture

- Blogs and distribution warehousing

Why invest:

- Low labor rates, Competitive labor cost

- Reformation of the government and FDI incentives

- Free trade agreements with the big markets

6. Estonia: The European Digital Pioneer

Estonia is a highly digitalized country in the world. Its e-residency solution, low-tax regime, and an economy that thrives on innovation make it an ideal location to start or invest in a tech-related business.

Fast-growth sectors:

- Digital services and SaaS

- Cybersecurity

- Web3 and blockchain

Why invest:

- Digital business with simplified incorporation/ Streamlined digital company incorporation

- Low bureaucracy

- Digital literacy

7. Canada – Friendly and abundant

Canada offers a futuristic location to invest in the world because it is an economically sound nation with diversified natural resources as well as an adequate labour force. It is a secure and controlled region of investment for both local and foreign investors.

Key sectors:

- Mine and green power

- City and real estate development

- Technology centers (including Toronto and Vancouver), innovation centers

Why invest:

- Open legal systems

- Access to the global market (to the US, specifically)

- Quality of life is good

8. Poland – Business jewel of Eastern Europe

Poland can be called a mixture of low cost of doing business and high potential that can be doubled in the IT as well as in logistics. Membership with the EU gives a wider European market as far as investors are concerned.

Promising areas:

- IT and Software Outsourcing

- Machinery and giving

- Logistics and warehousing

Why invest:

- Skilled and cheap labor (educated)

- Governmental support of the startups

- Europe would be in an advantageous position.

9. Australia- A Window to the Asia-Pacific

Australia is known to be a highly regulated state with a vibrant financial sector. It is a stable option in terms of international business and investment since it is located close to Asia, and its economic relations are very strong.

Key sectors:

- Infrastructure and property

- Rare earths and mining

- Learning and travel

Why invest:

- Clearance of tax and legalities

- Quality of life: High

- Resilient economy

10. Brazil: A Country with Unutilized Potential

Brazil has a huge domestic market and huge natural resources. Although it can be accompanied by political and economic risks, the benefits of people who go through it adequately can be very high.

Growth sectors:

- Export on food and agriculture

- Renewable energy (particularly hydro and wind energy)

- Online shops and websites

Why invest:

- Enormous customer base

- South America Trade Connectivity

- Increased use of digital media

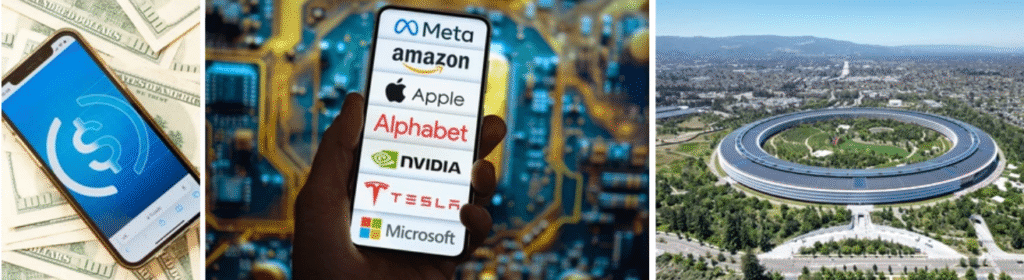

11. United States of America- Innovation and Capital of the World

The United States remains a first-rate investment destination due to its large consumer market, quality universities, and continuous growth in innovation. It is the place that hosts some of the most valuable businesses in the world, and it offers access to capital and access to technology that cannot be compared to anything.

Leading industries:

- Technology (Silicon Valley)

- Biotechnology and medical care

- Property (particularly within developing states such as Texas or Florida)

Why invest:

- Stock markets of substance

- Protection of investors legally

- Strong international muscle and economic strength

The USA attracts investors of any profile, be it venture capital, real estate, or stock investing, with the support of a developed and transparent financial system.

Closing Remarks – Best Countries to Invest In 2025

Where to invest is not only about economic figures, but rather determining your right fit, countries that support your objectives, notions of shared society, and appetites for risk. All you have to do is choose from one of the tech-centric hubs, such as Estonia and Singapore, to a resource-rich economy, such as Brazil and Canada, and revenue opportunities will be ready to be exploited.

Country-wide diversification helps in preventing your risk and also opens you to new markets, networks, and ideas. In that case, when you develop a business or you increase your portfolio, then think of going as intelligent money travels across borders.

FAQs: Best Countries to Invest In 2025

Q1: Where do I begin my taste of international investing?

A: There is global investing using international mutual funds and exchange-traded funds, real estate platforms, or establishing operations in distant markets.

Q2: What are the Best Countries to Invest In 2025, in terms of low-risk investors?

A: Countries such as Canada, Germany, and Singapore promise good legal conditions and solid economies.

Q3: What are the dangers of foreign investment?

A: Any currency volatility, regulatory variation, and political uncertainties. The keys to it are diversifying and doing proper research.

Q4: Do small investors get any advantage with international investing?

A: Yes! Fractional investing and digital platforms are helping minuscule investors to invest in and be exposed to foreign markets as well.