Let’s discuss how many jobs are available in finance. Here are some roles in demand, and how you can break into this thriving industry. A friendly, detailed guide for students, career switchers, and curious minds.

Have you ever wondered just how many opportunities are out there in finance? Maybe you’re a student thinking about your future, someone looking for a career switch, or just plain curious. Either way, you’re in the right place. The finance industry is huge, and guess what? It’s not all about number crunching or working on Wall Street. Finance jobs are everywhere—from banks and insurance companies to tech startups and nonprofits.

In this friendly guide, we’re going to break down just how many jobs are available in finance, what kinds of roles exist, where the biggest opportunities are, and how you can become a part of this dynamic field.

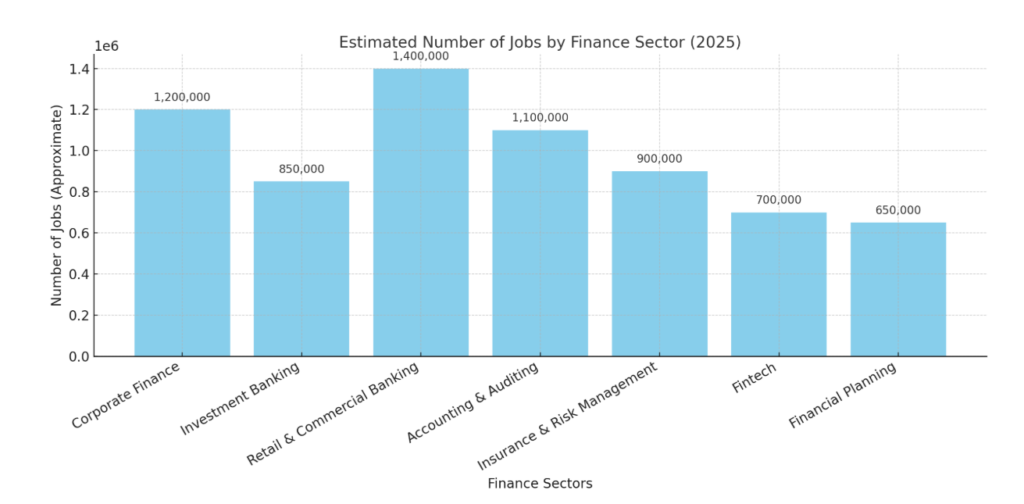

How Many Finance Jobs Are Out There?

Let’s start with some numbers. According to the U.S. Bureau of Labor Statistics (BLS), over 8.9 million people are currently working in finance and insurance in the U.S. alone. That’s nearly the population of New York City—all working in finance-related roles! And the number is growing steadily.

Globally, tens of millions more are employed across banking, investment, insurance, accounting, financial planning, and the rapidly growing fintech sector.

Highlights:

-

U.S. finance job openings per year: Over 400,000 added in 2024.

-

Global fintech job growth: Expected to reach 500,000+ by 2026.

-

Fastest-growing roles: Financial analysts, compliance officers, fintech developers, ESG analysts, and risk managers.

So, if you’re wondering whether there’s room for you in this space, the answer is a big YES!

What Exactly Counts as a Finance Job?

A finance job isn’t just one thing. It’s a massive umbrella that covers everything from helping someone plan their retirement to making billion-dollar decisions for global corporations. Let’s break it down into the most common categories, with examples to help you see what fits your interests.

1. Corporate Finance

Think of this as working inside a company to help manage its money, making smart decisions about budgeting, spending, and investment.

Jobs in this space:

-

Financial Analyst – You analyze financial data and help companies make informed decisions.

-

Treasury Analyst – You manage the company’s cash, investments, and risk.

-

CFO (Chief Financial Officer) – You lead the company’s entire financial strategy (usually after years of experience!).

-

Budget Analyst – You create and manage budgets to keep projects and departments on track.

Who it’s great for: People who enjoy strategy, analysis, and playing a key role behind the scenes in a business’s success.

2. Investment Banking

This is the high-stakes world of raising money for big companies, managing mergers and acquisitions, and advising on investments. It’s fast-paced, competitive, and often comes with long hours—but big rewards.

Common roles:

-

Investment Banker – Help companies raise capital by issuing stocks or bonds.

-

Equity Analyst – Research and recommend stock investments.

-

M&A Analyst – Advise on company mergers and acquisitions.

Who it’s great for: If you love working under pressure, solving puzzles, and making big-picture financial decisions.

3. Retail and Commercial Banking

This is the finance we interact with every day—checking accounts, mortgages, loans, etc. Whether you’re working with individuals (retail) or businesses (commercial), there’s a lot of variety here.

Key roles:

-

Loan Officer – Evaluate and approve loan applications.

-

Branch Manager – Oversee a bank branch’s daily operations.

-

Relationship Manager – Build long-term relationships with clients.

Who it’s great for: People who enjoy helping others and want a more traditional 9–5 career in finance.

4. Accounting and Auditing

These are the detail-oriented folks making sure everything adds up. From preparing financial statements to catching fraud, accountants and auditors are essential.

Popular careers:

-

Certified Public Accountant (CPA) – Handle taxes, financial statements, and consulting.

-

Forensic Accountant – Investigate financial crimes and disputes.

-

Internal Auditor – Evaluate a company’s internal controls and risk management.

Who it’s great for: People who like accuracy, solving financial puzzles, and keeping businesses honest and efficient.

5. Insurance and Risk Management

Helping people and businesses prepare for the unexpected is what this sector is all about.

Roles to consider:

-

Actuary – Use math and statistics to predict risk and set insurance rates.

-

Claims Adjuster – Evaluate insurance claims to determine payouts.

-

Risk Analyst – Identify and reduce financial risks for companies.

Who it’s great for: If you love statistics, forecasting, and creating safety nets for people and organizations.

6. Fintech (Financial Technology)

This is one of the fastest-growing areas in finance. Think of apps like Venmo, PayPal, Robinhood, or crypto wallets—this is where finance meets tech.

Hot jobs:

-

Fintech Product Manager – Design and manage finance apps.

-

Blockchain Analyst – Work on cryptocurrency and digital ledger systems.

-

Data Analyst – Use big data to optimize financial products.

-

Cybersecurity Specialist – Protect financial data from hackers.

Who it’s great for: Tech-savvy people who love innovation and want to shape the future of finance.

7. Financial Planning & Wealth Management

This is all about helping people make smart decisions with their money—whether it’s saving for college, investing in stocks, or planning retirement.

Common roles:

-

Financial Advisor – Offer personalized investment and retirement advice.

-

Wealth Manager – Manage the finances of high-net-worth individuals.

-

Estate Planner – Help clients plan for the transfer of their wealth.

Who it’s great for: People who are great communicators and genuinely enjoy helping others achieve financial peace of mind.

Top Finance Jobs in Demand (Right Now!)

Let’s get real—some finance roles are simply hotter than others right now. Here are the ones seeing a big surge in demand in 2025:

-

Financial Analysts – Every business needs someone to interpret numbers and provide insights.

-

Compliance Officers – As regulations tighten, companies are hiring experts to stay on the right side of the law.

-

Fintech Developers – Finance apps and digital tools are booming.

-

ESG Analysts (Environmental, Social, and Governance) – Companies now want to be profitable and sustainable.

-

Risk Managers – Especially after recent global financial shocks, this role is more important than ever.

What Skills Do You Need?

Finance isn’t just about knowing math. Here’s a breakdown of both technical and soft skills that can help you land and succeed in finance jobs:

Technical Skills:

-

Financial modeling (Excel, Google Sheets)

-

Data analysis (SQL, Python, Tableau)

-

Understanding of regulations (especially if you’re in compliance)

-

ERP software (like Oracle, SAP)

-

Budgeting and forecasting tools

Soft Skills:

-

Attention to detail

-

Communication (especially for client-facing roles)

-

Problem-solving and decision-making

-

Ethics and integrity

-

Teamwork and leadership

Certifications That Give You an Edge:

-

CFA – Best for investment roles

-

CPA – Must-have for accounting

-

FRM – Great for risk management

-

CMA – For management accounting

Finance Jobs Around the World

Finance is a global industry, and the opportunities vary from country to country:

🇺🇸 United States:

-

Strong job growth in New York, San Francisco, and Austin

-

Big opportunities in fintech, ESG, and financial planning

🇬🇧 United Kingdom:

-

London remains Europe’s financial capital

-

Rise in sustainable finance and digital banking jobs

🇮🇳 India:

-

The booming fintech sector with 1 million+ jobs

-

Finance hubs include Mumbai, Bangalore, and Hyderabad

🇸🇬 Singapore & 🇭🇰 Hong Kong:

-

Huge demand for compliance officers, data analysts, and wealth managers

-

Regional headquarters for many global financial firms

How to Get Started in Finance

Feeling inspired? Here’s how you can get your foot in the door.

Start with Education:

-

A degree in finance, accounting, business, or economics is a great foundation.

-

Even non-finance majors can get into finance with certifications or experience.

Get Experience:

-

Internships are golden!

-

Start with entry-level roles like junior analyst or finance assistant.

Upskill Online:

-

Platforms like Coursera, edX, and LinkedIn Learning offer great finance courses.

-

Try a financial modeling or fintech bootcamp.

Build Your Network:

-

Attend finance events and conferences

-

Join LinkedIn groups or local finance communities

-

Don’t be shy to reach out for informational interviews

The Future of Finance Jobs

The finance industry is changing—and that’s exciting! Here are a few trends shaping the future:

-

Automation & AI – Some tasks will be automated, but it will also create new jobs.

-

Remote Finance Roles – Many finance jobs can now be done from anywhere.

-

Decentralized Finance (DeFi) – Blockchain is opening up brand-new career paths.

-

Sustainability in Finance – ESG roles are growing like never before.

Bottom line? Finance isn’t going anywhere—it’s evolving. And those who adapt with it will have long, successful careers.

Final Thoughts: Jobs Available in Finance

A resounding yes answer proves suitable for the question. Children of all intellectual inclinations can discover their ideal financial opportunity because finance offers diverse career paths. The industry size continues to grow while searching for individuals who possess your level of intelligence and determination. There is no need to be a mathematical genius in this field. Finance is an industry that exists to resolve essential challenges by understanding human needs so the global economic system continues to function. Start your exploration of finance education and application right now as that future path fits you perfectly. Who knows? The right position in finance exists somewhere very near your present location.

FAQs – Jobs Available in Finance

Q: How do I know if finance is right for me?

A: If you enjoy solving problems, working with numbers or people, and making strategic decisions, finance could be a great fit.

Q: What’s the best beginner role in finance?

A: Entry-level analyst roles, financial assistant jobs, or internships are great starting points.

Q: Do I need a finance degree?

A: It helps, but it’s not essential. Many people get in with business, economics, or tech backgrounds—plus certifications.

Q: Is finance a stressful field?

A: It can be at times (especially in investment banking), but many roles offer work-life balance, especially in planning, accounting, or fintech.